Some market commentators have been suggesting that this recent change in fortunes is the next so called ‘Value Rally’.

Summary

- The FTSE 100, which represents the largest 100 companies in the UK, has gone from a long-term underperformer to one of the strongest global markets in the last few weeks.

- The FTSE 100 index make-up is unusual as it has lots of ‘old’ industry stocks such as the miners, oil & gas, utilities and banks and has very little exposure to new industries such as technology. It is an index that also excludes medium and smaller sized companies.

- The current market direction is being driven by uncertainty over inflation and interest rates and not necessarily by the health of the respective companies within it.

- We are doubtful that the FTSE 100 will be a long-term leader on the global stage once the current turmoil is behind us – the timing of this remains as challenging as ever.

For many fund managers and markets, January was one of the toughest months on record. The combination of rising inflation figures, the increasing prospect of a conflict between Russia and Ukraine, some poor earnings reports and rising interest rates triggered a near panic in ‘growth’ stocks, battering markets such as the US tech-heavy Nasdaq index, which was down -8%, and the UK mid-cap FTSE 250 index, which ended the month -7%.

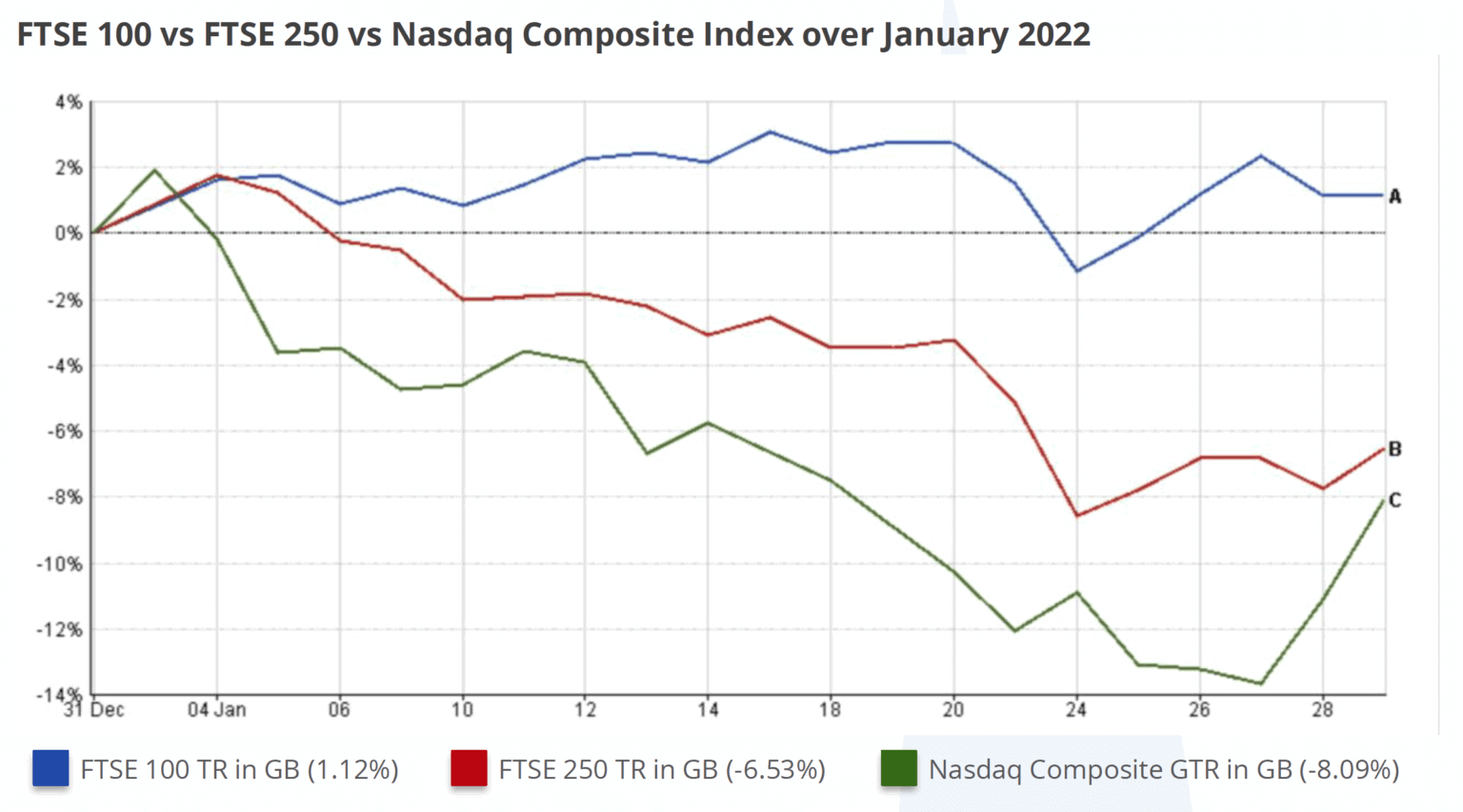

The FTSE 100, with its heavy weighting in large oil, mining, tobacco, utilities, and financials/banking companies seemed rather sheltered from the shock, and rose +1.1% over the month, making it one of the best performing major indices in the world during this short period. These sectors tend to be heavily regulated, capital intensive with a lot of profits being ploughed back into their operations such as rebuilding infrastructure (think water companies and the Victorian era drainage system we have in Britain) and in some cases have their prices set by the government. Many of these businesses do not have very exciting growth prospects and thus tend to be avoided by active fund managers who tend to invest in companies which are growing faster than the market average. As such, many active fund managers and investment portfolios, including our own, have underperformed of late. Below is a chart of the recent performance of the FTSE 100 (the largest 100 companies in the UK), the FTSE 250 (the next largest 250 companies) and the Nasdaq (a US tech heavy index). The contrasts in performance is stark.

Source: FE fundinfo 2022. Data as at 31st January 2022

Some market commentators have been suggesting that this recent change in fortunes is the next so called ‘Value Rally’. The contrasting shift into these ‘value’ stocks led to a big reversal of fortune, favouring oil, tobacco and banking stocks while quality growth companies fell. The latter is where our fund managers tend to favour.

We believe that this is a sentiment driven event, not driven by company fundamentals but rather the market’s current obsession with inflation, interest rates and increasingly, whether Russia will invade Ukraine. For example, recent earnings reports from the likes of Diageo (which owns brands such as Guinness, Baileys & Smirnoff), LVMH (which owns a stable of brands such as Hennessy, Christian Dior, Givenchy & Marc Jacobs), Microsoft, Google and Amazon have been excellent, which goes some way to reinforcing this view that at some point those companies can continue to prosper. We are therefore of the view that this will unwind before long.

Over recent weeks, FTSE 100 stocks such as BP, HSBC and British American Tobacco have risen sharply, whilst many of our core portfolio holdings have headed in the reverse direction. We see this as a potential buying opportunity in quality growth stocks, which are in the January sales, many with up to 25% off. They are growing well, with strong underlying revenue growth, are profitable, and in most cases, have large amounts of cash on the balance sheet.

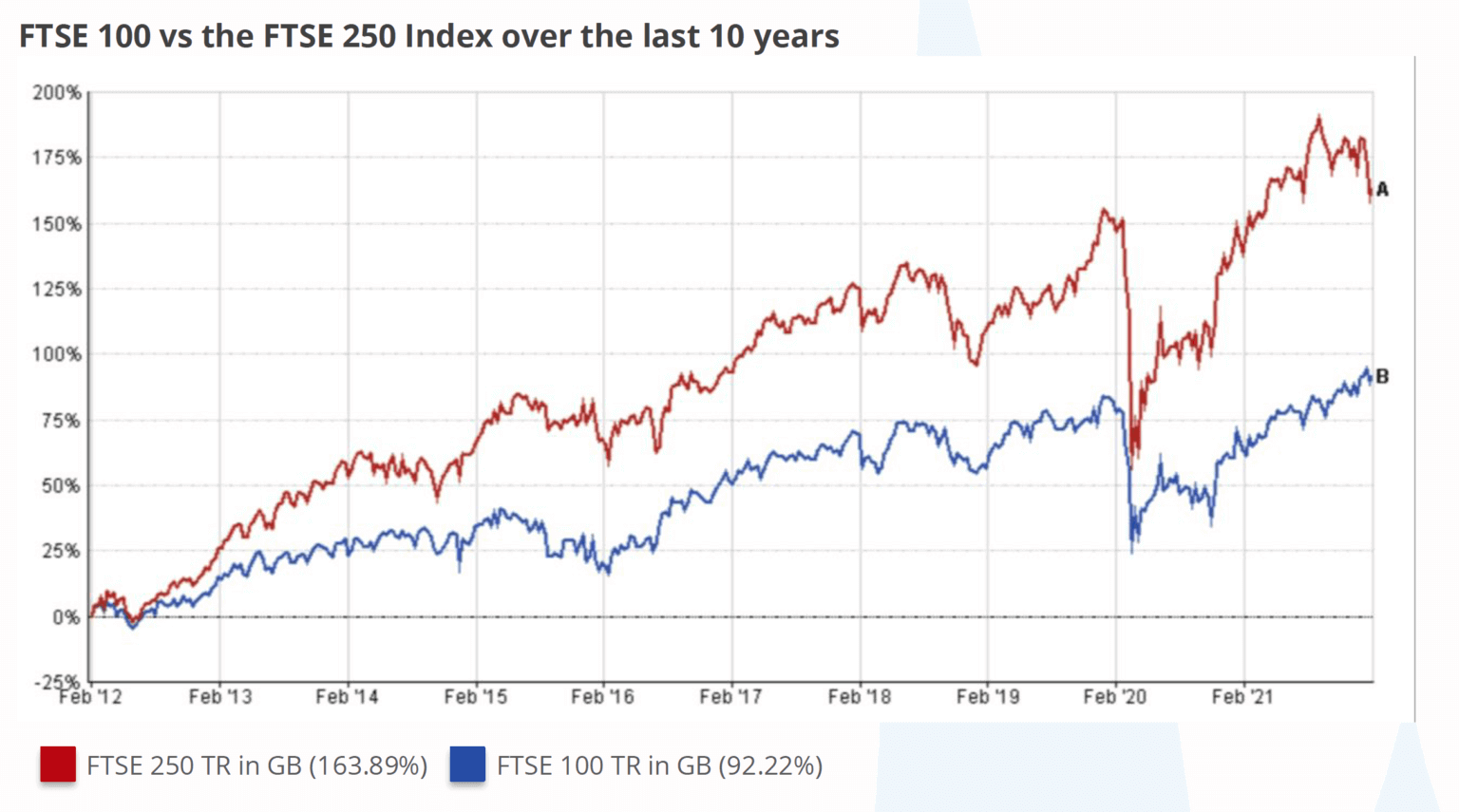

When we review the longer-term performance of the FTSE 100 and the FTSE 250, we see that there is quite a discrepancy in favour of the mid-sized firms reflecting their stronger long term growth prospects and we think that this pattern will resume in the near future, but the timing of this is as impossible to forecast as ever.

Source: FE fundinfo 2022. Data as at 31st January 2022

Over the course of this year, we expect UK and US interest rates to increase steadily, accompanied by a gradual unwinding of all the support that bond markets have had from central banks’ via their Quantitative Easing programmes. Economic growth looks set to continue, so we regard the return of interest rates to more ‘normal’ levels as a good thing. Inflation looks set to peak over the first few months of this year, but energy prices remain a concern and much is dependent on a diplomatic solution in Ukraine, and it seems to be unlikely that inflation will be back at central bank targets any time soon.

Importantly, whilst this remains a challenging environment, the underlying companies in our portfolios are still delivering strong results and increasing profits, and this should see their share prices return to rude health as time marches on. As we steered last year, we think that the ride for equities will remain bumpy and potentially perplexing for investors for some time to come.

Andrew, Charles, Chris, Dan, Mark & Will

The Investment Management Team, Square Mile

Tuesday 8th February 2022

Park Hall Financial Services Limited is authorised and regulated by the Financial Conduct Authority.

The information within this article is for information purposes only and does not constitute investment advice. They represent the opinions of the fund manager and those of Square Mile. It does not contain all of the information which as an investor may require in order to make an investment decision. Any reference to shares/investments is not a recommendation to buy or sell. If you are unsure, you should seek professional independent financial advice.

Past performance is not a guide to future performance. The value of any investment and any income from it is not guaranteed and can fluctuate depending on investment performance and other factors. you could get back less than you invested.

Some investments, e.g. property, may be difficult to sell and will be subject to market conditions at that time. Their value is the opinion of an independent valuer.

Any reference to taxation is dependent on your own particular circumstances which are subject to change.