Over the last 46 years of the FE International Equity Proxy data, 76.1% of the calendar year returns have been positive.

Summary

- The first five months of 2022 have been the third-worst performing period for FE International Equity Proxy* (International Equity) since 1975.

- Don’t panic, markets invariably correct faster than expected and can bounce back faster than predicted. This is why investing should be for the medium to long term.

- Over the last 46 years of the FE International Equity Proxy data, 76.1% of the calendar year returns have been positive.

There is no denying that 2022 has been difficult for markets and investors. In fact, the first five months of the year have been the third-worst performing period for the FE International Equity Proxy since 1975, having returned -7.4% YTD (as of 30th April 2022).

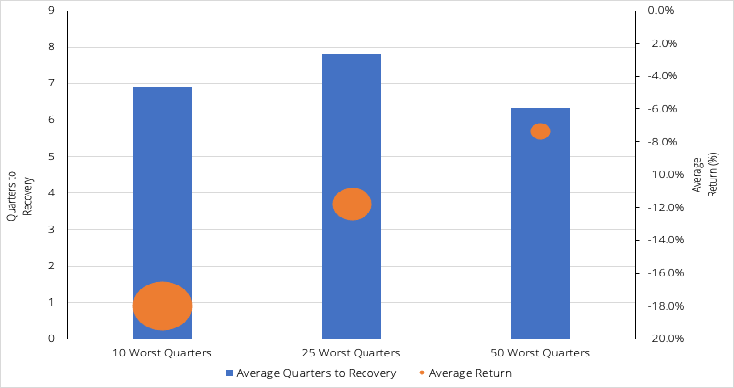

In principle, buying when markets are down and selling when they are up is simple, especially with hindsight. In reality, however, we know that this is much harder. What we do acknowledge is that markets can bounce back quicker than expectations. This is demonstrated in the chart below which shows the worst 10, 25 and 50 quarters since 31st January 1975 and the average length of market recovery.

FE International Equity Proxy: Worst quarters average quarters to recovery and average return, 31st January 1975 to 30th April 2022.

Source: Square Mile and FE fund info. Data as of 30th April 2022. Past performance is not a guide to future performance.

The above chart illustrates that the worst 10 quarters of the FE International Equity Proxy took on average under seven quarters to recover and returned on average -18% after the first worst quarter. The worst 25 quarters took on average just under eight quarters to recover and returned on average -11% after four quarters, whilst the worst 50 quarters took just over six quarters on average to recover and returned an average return of -7%. This chart emphasises the importance of maintaining a long-term view when investing, and whilst short term performance concerns can cause panic, markets do tend to recover in a shorter time period than usually expected.

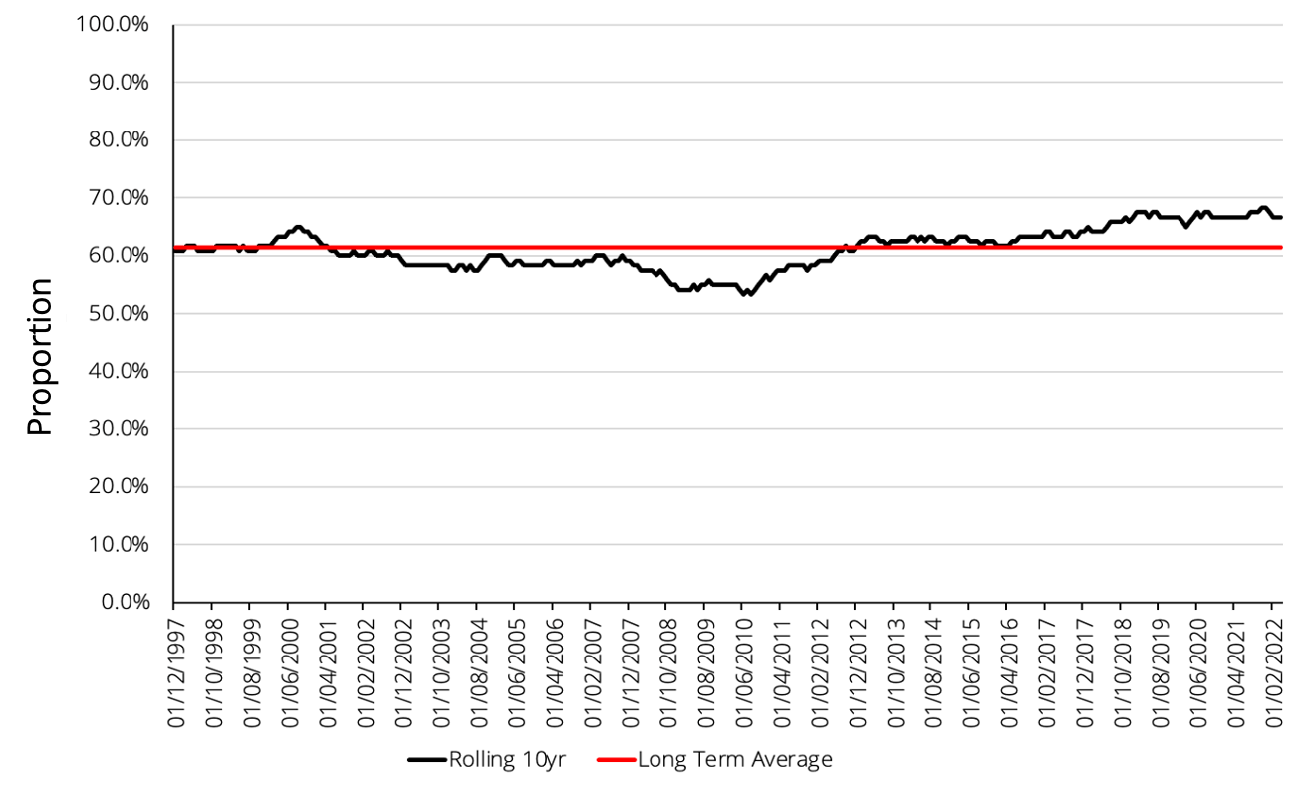

Given the run of the recent bull market, it is understandable that investors may not have experienced or forgotten negative returns. Since 1975, the FE International Equity Proxy has delivered positive monthly returns 62.8% of this time. Over rolling ten-year periods this ratio has broadly stayed the same and has always been above 50%. As illustrated in the chart below, the more recent ten-year periods have been higher than average and therefore these negative monthly returns may come as a surprise to some investors.

FE International Equity Proxy: Proportion of positive monthly returns over rolling 10-year periods, 31st January 1975 to 30th April 2022

Source: Square Mile and FE fund info. Data as at 30th April 2022. Past performance is not a guide to future performance.

The positive numbers for calendar year returns are even stronger. Over the last 46 years to now (31st January 1975 to 30th April 2022), just over three quarters (76.1%) of calendar year returns of the FE International Equity Proxy in GBP have been positive. Furthermore, from the end of 2003 there have only been three negative calendar years. Given how strong markets have been over recent years, the law of averages would suggest that a period of negative absolute returns from global equities should be expected. We are, however, aware, that we are not even halfway through 2022, and a number of factors could change over the course of the rest of the year which can impact markets.

Overall, we acknowledge that markets have got off to a very tricky start in 2022. The macro-outlook for the global economy is potentially not as positive as we would like with inflation continuing to rise globally, central banks expected to raise rates and many experts expecting several major economies to enter recessions. Whilst this is unnerving for investors, it is important to remember that markets have been through tougher periods and have come back stronger. Given these concerns it is understandable that clients may be nervous about investing lump sums, therefore it may be prudent to suggest that they drip those investments in over the course of a number of months. It is extremely difficult to time the market, however history shows that its time in the market that drives returns.

*Due to licence agreements, Square Mile are unable to quote standard benchmarks from providers such as FTSE and MSCI, which is why the FE International Equity Proxy has been used in this analysis. Throughout the document we refer to this as International Equity. The FE International Equity Proxy has been devised by FE Fund info as a proxy for international equities and over the last twenty years to 30th April 2022 it has a correlation of 0.99 to major global equity indices.

Park Hall Financial Services Limited is authorised and regulated by the Financial Conduct Authority.

The information within this article is for information purposes only and does not constitute investment advice. They represent the opinions of the fund manager and those of Square Mile. It does not contain all of the information which as an investor may require in order to make an investment decision. Any reference to shares/investments is not a recommendation to buy or sell. If you are unsure, you should seek professional independent financial advice.

Past performance is not a guide to future performance. The value of any investment and any income from it is not guaranteed and can fluctuate depending on investment performance and other factors. you could get back less than you invested.

Some investments, e.g. property, may be difficult to sell and will be subject to market conditions at that time. Their value is the opinion of an independent valuer.

Any reference to taxation is dependent on your own particular circumstances which are subject to change.