Successful investing has always been as much about clear thinking and controlling your emotions as it has about technical factors like PE ratios and balance sheets.

Download this article to read later - PDF

It has been very difficult start to 2022 for investors. Worries about rising inflation and interest rates have been exacerbated by the conflict in Ukraine. Stock markets have been volatile, with the Top 100 companies in the UK tumbling by 3.6% on 24th February 2022.

Successful investing has always been as much about clear thinking and controlling your emotions as it has about technical factors like PE ratios and balance sheets. So, although there is currently much uncertainty, we believe strongly that it is not a time to panic. In contrast, recent events only emphasise the importance of taking a long-term view.

Playing the long game

Since 1990 there have been some significant falls in stock markets, notably in 2002 and again in 2008. Despite this, and as shown in the graph below, a balanced portfolio consisting of 50% in global stocks (represented by a leading World Index provider in sterling terms) and 50% in global bonds (represented by one of the UK’s leading high street Global Aggregate Hedge GBP Index) has outperformed the Bank of England Base Rate over any rolling 15-year period. Over 10-year periods, it has outperformed 86% of the time.

50% Global Company Index and 50% UK Banks Aggregate Hedge GBP Vs. Bank of England Base Rate, rolling 15 Year returns

Source: Park Hall Data supplied by third parties. Data as of 31st January 2022. Past performance is not a guide to future returns.

Wars don’t have a long-term impact on markets

As we watch the horrific events unfold in Ukraine, we do not want to downplay for a moment the emotional and economic scarring being inflicted on those who are directly and unintentionally being caught up in the conflict. Hundreds of thousands of civilians are being displaced and a full-blown refugee crisis is underway.

However, looking at how the largest 100 companies in the UK was affected by both the Gulf War in 1990 and the 9/11 terrorist attacks, it shows how quickly stock markets can recover from such events. In August and September 1990, A leading 100 companies index in the UK fell 13.5% but it had recouped all of this loss by February 1991. Similarly, the same index fell 8.1% in September 2001 but this loss was recovered by March 2002.

If the war remains contained within Ukraine and Russia, then historical precedent suggests stock market losses will be short-lived and investors will quickly look beyond the conflict.

The risk of panic selling

If you panic and sell:

- You lock in your losses.

- You miss out on the best returns that often follow.

Some of the biggest daily losses have been followed by some of the biggest daily gains. In the final quarter of 2008, for example, a leading 100 UK companies Index saw four of its worst ten days since 1986. However, over the same period, the Index also experienced six of its best ten days. This just goes to show that timing the market is impossible over the short term and it is almost always best to stay invested.

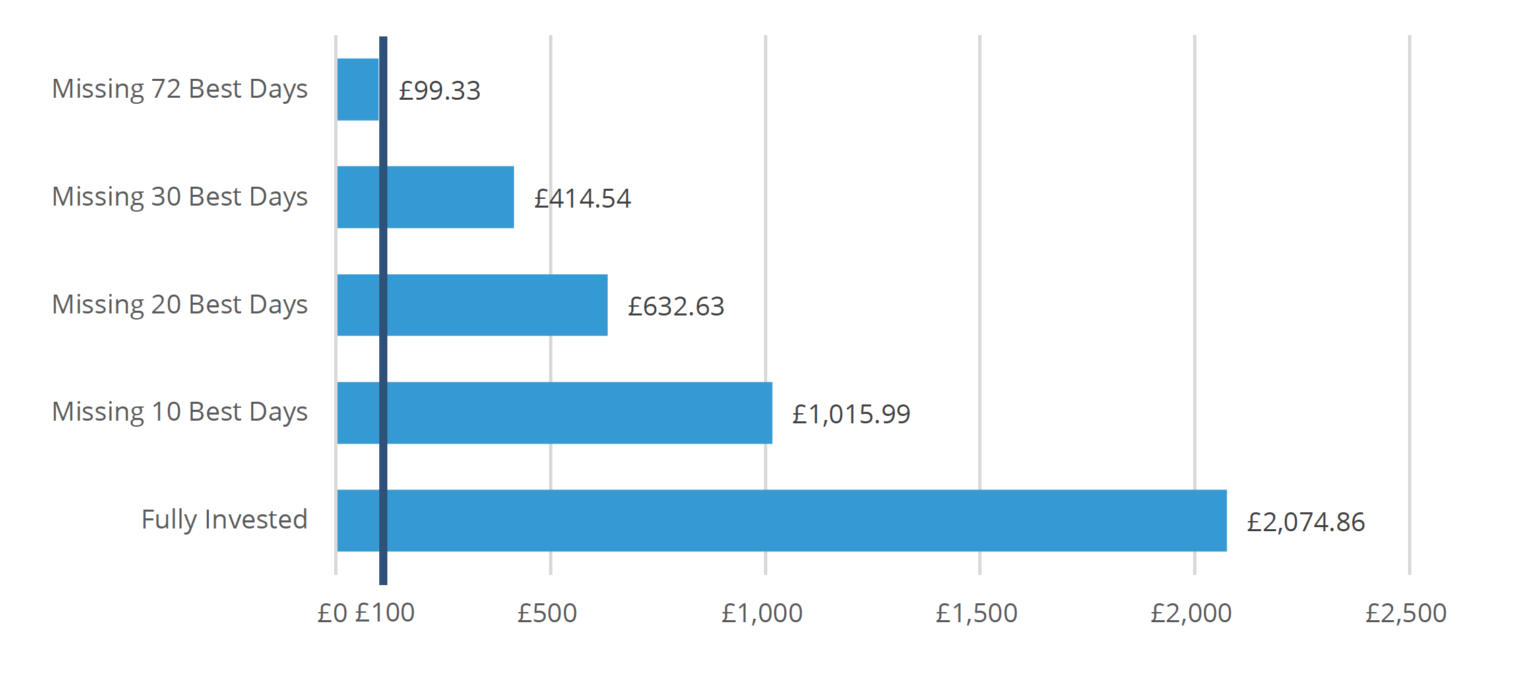

As is illustrated in the chart below, if an investor, who had originally invested £100, had missed out on just the top ten best days for the largest 100 companies in the UK since the end of 1985, then their return would have been just half of an investor who had remained fully invested. If an investor had missed the best 72 days, they would actually have lost money.

Top 100 UK companies by size – Performance from £100 Investment, 31/12/1985 to 31/01/2022

Source: Park Hall third party data supplied. Data as of 31st January 2022. Past performance is not a guide to future returns.

We completely understand the temptation and tendency to panic when share prices are falling. It is human nature. However, all the evidence and past precedent suggests that at times like this the best investment strategy is to remain calm, to stay invested and that this will be to their benefit over the long term.

The following warnings represent the investment and currency risks associated with the asset classes typically represented in the asset allocation for your chosen risk profile of ‘’Moderate.’’

- Investments are intended to be for the medium to long term.

- The price of units and the income from equity-based investments can fall, as well as rise.

- The value of investments is not guaranteed, and, on any encashment, you may not get back the full amount you may have invested.

- If withdrawals and charges from an investment are made at a rate which exceeds the net growth of the fund, capital may be eroded.

- You should also be aware of currency risk. Currencies – for example sterling, euros, dollars, yen – move in relation to one another. If you are putting your money into investments in another country, then their value will move up and down in line with currency changes as well as the normal share-price movements. This risk will also influence the currency in which you wish the benefits to be held.

- Corporate Bond funds mainly invest in bonds where the risk of default is low. Investment in corporate bonds has exposure to the risk of non-payment on the part of the issuer and bond prices are sensitive to changes in interest rates.

- The issuers (including Government Bonds and Corporate Bonds) are graded according to their credit rating with the credit ratings agencies (Standard & Poor’s).

- Investment Grade Corporate Bonds are generally perceived to carry a greater risk of capital loss than, for example, higher rated UK or US Government Bonds.

- Inflation risk: means that you will need more money in the future to buy the same things as now. Investing in cash is unlikely to beat inflation in the long-term.

- The tax treatment of investments depends on each investor’s individual circumstances and is subject to changes in tax legislation.

- Property funds in exceptional circumstances can delay encashment, fund switching or transfer for several months, as property can take time to sell and access to your money may be restricted.

- You should review the investments within your portfolio on a regular basis.

- Money Market/Liquidity Funds -There are still investment risks associated with Money Market / Liquidity Funds. They are not cash deposit accounts but invest in money market instruments and short-term bonds and can fall in value in a low interest environment. The charges applied to a cash fund may be greater than its return, so you could get back less than you paid in.

Park Hall Financial Services Limited is authorised and regulated by the Financial Conduct Authority.

The information within this article is for information purposes only and does not constitute investment advice. They represent the opinions of the fund manager and those of Square Mile. It does not contain all of the information which as an investor may require in order to make an investment decision. Any reference to shares/investments is not a recommendation to buy or sell. If you are unsure, you should seek professional independent financial advice.

Past performance is not a guide to future performance. The value of any investment and any income from it is not guaranteed and can fluctuate depending on investment performance and other factors. you could get back less than you invested.

Some investments, e.g. property, may be difficult to sell and will be subject to market conditions at that time. Their value is the opinion of an independent valuer.

Any reference to taxation is dependent on your own particular circumstances which are subject to change.