December 16, 2021

A review of the financial markets in 2021 and outlook for 2022

Home / A review of the fin...

The UK economy is expected to have grown by 6-7% in 2021 and corporate profits have rebounded. The UK has also been at the forefront of the global vaccine rollout.

Despite double-digit returns from most equity markets, 2021 still presented plenty of challenges for investors. A tug-of-war raged between COVID variants and vaccines, many economies experienced their highest levels of inflation for thirty years and, in China, the authorities launched a brutal clampdown on the country’s most successful companies whilst at the same time the world’s most indebted property developer teetered on the brink of collapse.

At the time of writing, UK equities have provided a return (including dividends) of just over 17%, more than erasing 2020’s decline of 10%. The UK economy is expected to have grown by 6-7% in 2021 and corporate profits have rebounded. The UK has also been at the forefront of the global vaccine rollout.

Many overseas stock markets recorded even bigger gains, headed once again by the US which has risen by 30% in sterling terms. An eclectic mix of a vaccine-maker (Moderna), a technology behemoth (NVIDIA) and a clutch of oil companies have all seen their stock prices more than double in 2021, whilst Tesla joined the elite club of companies valued at more than US$1trn. At the other end of the performance table and for the reasons above, Chinese equities were down in 2021.

Even though the pledges made at November’s showpiece COP26 climate change conference in Glasgow disappointed many, the emphasis on environmental, social and governance (ESG) factors amongst investors became an even more powerful force in 2021. Fund managers ignore this trend at their peril.

Investors in government bonds have lost money in 2021, albeit not as much as we and many others would have expected given the degree to which interest and capital repayments have been eroded in real terms by soaring inflation rates.

At the beginning of 2021, 10-year UK gilt yields stood at just 0.2%. As growth and inflation picked up, yields rose six-fold to 1.2% and at worst broad gilt market indices were down by almost 9%. It is perplexing therefore that, even as the UK inflation rate has continued to rise, 10-year yields have since tumbled to 0.75%. Losses for investors in UK gilts have narrowed to just 2%.

The economic and monetary backdrop in 2021 could not have been more benign for investors in equity markets. The rollout of vaccines allowed economies to re-open, releasing a surge of pent-up demand. Indeed, that demand has led to shortages in many parts of the supply spectrum, ranging from labour to semiconductors to energy. Unsurprisingly, prices have risen accordingly. The price of shipping a standard 40ft container from Shanghai to Europe has increased approximately fivefold in 2021. Even though it has plummeted by nearly 40% over the last six weeks, the price of gas is still 50% higher than where it started the year, as is the price of oil.

Despite buoyant economic growth and rising inflation, both fiscal and monetary stimuli have remained in full flow. Central banks have seemed wary and reluctant to withdraw the punchbowl. The US Federal Reserve finally began to scale back its quantitative easing programme in November but will continue to buy bonds until June next year. Here in the UK, the Bank of England will complete its latest round of bond buying this month, taking its cumulative total to £895bn. Having hinted very strongly before its meeting in November that interest rates were set to rise from a historic low of 0.1%, the Bank then surprised almost everyone by leaving them unchanged and was accused of being an ‘unreliable boyfriend’.

Outlook for 2022

Markets will continue to grapple with many of the same factors and forces that have been present in 2021.

- As the emergence and rapid spread of the new Omicron variant has shown, the COVID pandemic is not over. Austria is coming to the end of a three-week lockdown, many other countries in Europe have re-introduced restrictions and England has just moved to ‘Plan B’, which includes guidance to work-from-home and makes facemasks mandatory again in most indoor public places. Countries will obviously revert to full lockdowns only as a last resort but the possibility that the virus, or new vaccine-resistant variants of it, could wreak further damage on economies and corporate profits cannot be ignored.

- The tapering and then the end of quantitative easing is in prospect for 2022. What impact will this have on bond markets whose repressed yields have long supported equity market valuations? In addition, soaring rates of inflation make the continuation of negligible and negative interest rates more and more untenable. Financial markets have operated in an environment of ultra-low bond yields and interest rates since the end of the Global Financial Crisis in 2009 and the transition to higher rates, if it comes, could be challenging.

- Of course, the biggest determinant of the likely path of interest rates in 2022 is inflation. For most of 2021, central banks maintained that the upward trend was ‘transitory’, caused by an unsustainable explosion in demand following the end of lockdowns which had temporarily overwhelmed supply chains. With every new data point that emerges, however, that argument is undermined and it is interesting that the Federal Reserve has recently decided to ‘retire’ the word from its messaging. We think that inflation rates could spike even higher in the short term before settling lower than they are at present, albeit at above the 2% level targeted by both the Bank of England and the Federal Reserve.

- We are fairly sanguine about the prospects for economic growth in 2022, expecting it to moderate from 2021’s rebound level but still be solid. As always, however, there are risks and amongst them we would cite a resurgence of the pandemic, a squeeze on consumer spending caused by higher inflation and, in the UK, higher taxes, or an exogenous event, such a property-related financial shock in China or military conflict.

In our opinion, the biggest risk to financial markets in 2022 is policy error by central banks. Do nothing or too little and the inflation genie, the scourge of the 1970s, might well and truly escape its bottle. However, excessive tightening of monetary policy could turn a slowdown in economic growth into a recession and also expose the high levels of debt embedded in the financial system. It is an exceptionally difficult balance to get right.

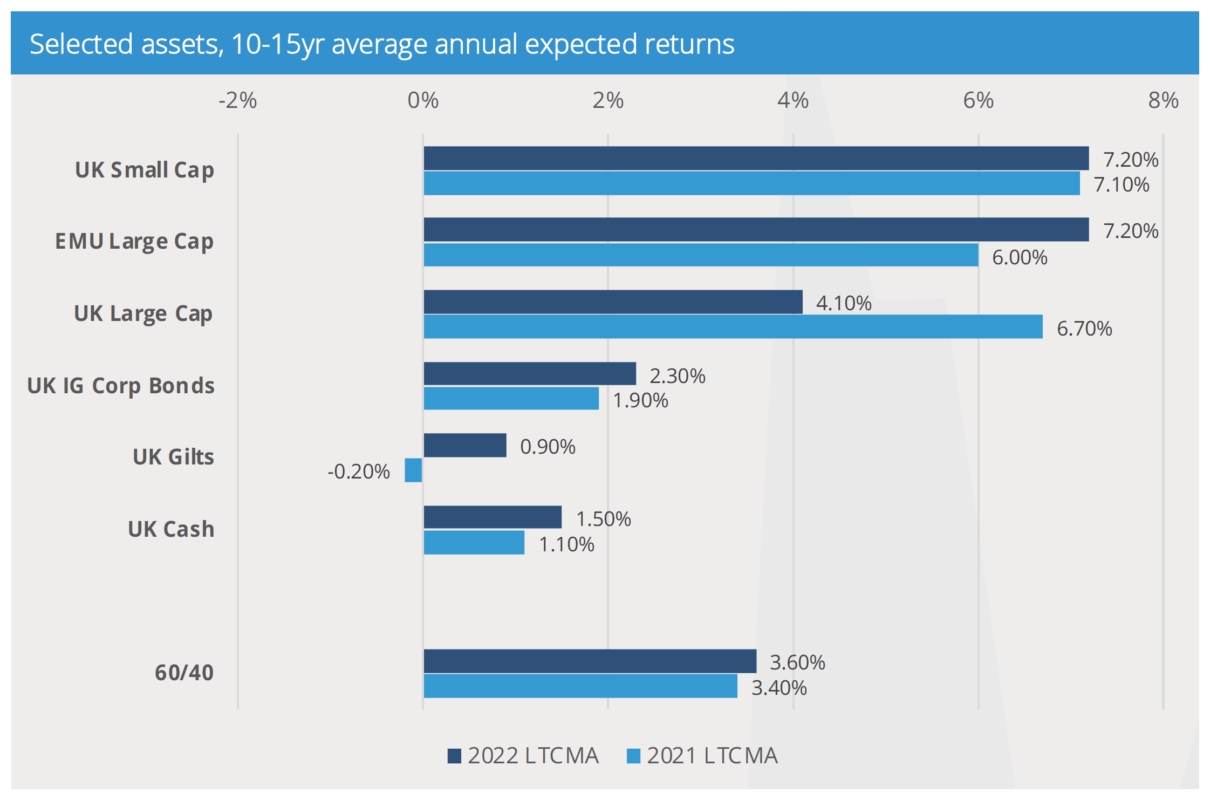

Not for the first time, we remind investors that returns from equity markets in 2021 (and indeed since the Global Financial Crisis) have been exceptional and are almost certainly not sustainable. Indeed, the chart on the following page (reprinted with the kind permission of JP Morgan Asset Management) predicts that, because of very low yields in bond markets and lofty valuations in stock markets, investors with balanced portfolios should not expect returns of more 4% p.a. over the next 10-15 years. We also warn that we expect financial markets to exhibit higher volatility as more than a decade of unprecedented monetary support comes to an end.

Source: Bloomberg, JP Morgan Asset Management, data as of September 2020 and September 2021

Forecasts are not a reliable indicator of future performance

Portfolio Positioning

Given the uncertainties, 2022 is not a year for taking big bets on asset allocation, geography or investment style. Instead, we will continue to seek to add value mainly through manager selection.

Against our most likely backdrop of robust economic growth, lingering inflation and the winding down of quantitative easing, we expect bond yields to trend higher in 2022. Accordingly, we will maintain our short duration bias in order to reduce the sensitivity of portfolios to higher bond yields. We continue to favour strategic and tactical bond funds whose flexible mandates allow their managers to cherry-pick the very best opportunities as they arise across the wide spectrum of bond markets.

Equity market valuations remain extremely high on any historical basis. However, with interest rates so negative in real terms (interest rates less inflation rates), and likely to remain so, we acknowledge that high valuations may persist. We expect corporate profits to be the main driver of share prices in 2022 and good stock selection will therefore be vital. This fits well with Square Mile’s core skillset of manager selection.

As always, we will remain alert and flexible to changing circumstances and we will not hesitate to take appropriate action within portfolios

Andrew, Charles, Chris, Dan, Mark, and Will

Square Mile Portfolio Management Team

Park Hall Financial Services Limited is authorised and regulated by the Financial Conduct Authority.

The information within this article is for information purposes only and does not constitute investment advice. They represent the opinions of the fund manager and those of Square Mile. It does not contain all of the information which as an investor may require in order to make an investment decision. Any reference to shares/investments is not a recommendation to buy or sell. If you are unsure, you should seek professional independent financial advice.

Past performance is not a guide to future performance. The value of any investment and any income from it is not guaranteed and can fluctuate depending on investment performance and other factors. you could get back less than you invested.

Some investments, e.g. property, may be difficult to sell and will be subject to market conditions at that time. Their value is the opinion of an independent valuer.

Any reference to taxation is dependent on your own particular circumstances which are subject to change.