Inflation figures have now hit 2.6% in the 12-month period to March this year, which breaches the Federal Reserve’s target of 2% and thereby raising fears it might increase rates to cool things down.

The outlook for equities and bonds is challenging but the view from our underlying fund managers is that the greatest valuation opportunities are in the UK, Asia and the global emerging markets.

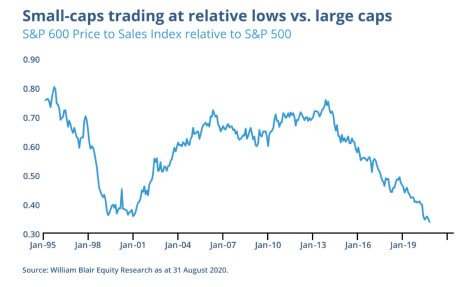

There is also some increased interest in US small-cap companies as the market has been more preoccupied with those stocks at the top end of the market cap spectrum. Sometimes the investment markets throw us interesting ideas and when thinking about positioning our portfolios we consider what might do well in the future rather than what has done well in the past – this chart is a great example:

It shows how smaller companies’ share prices have performed compared to their larger counterparts and although this is a few months old it reflects why managers are seeing an opportunity to make money through investing into the smaller US companies sector where prices now look as cheap as at any time over the last twenty-five years. This is one of the prime reasons for the fund managers on our favoured Artemis US Smaller Companies fund to be bullish on their prospects when we met with them in February.

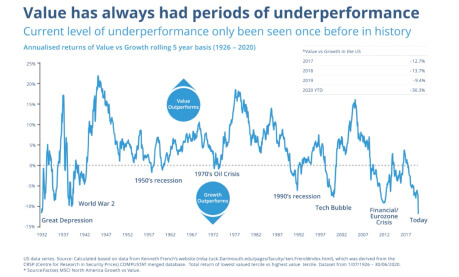

As for the UK and in some other markets there are some compelling opportunities, particularly in the so-called ‘value’ or cyclical parts of the market. Once again, here we see some very significant dispersion away from how they have traded traditionally compared to ‘growth’ companies which have now led the way for most of the last decade. This chart was highlighted as a reason for optimism by Ben Whitmore who manages the Jupiter UK Special Situations fund.

Unfortunately what the chart does not show is that there has been some pick up in value in the fourth quarter of last year. However, the ‘value’ end of the market had got as cheap as at any time since the great depression and this appears to us to still present an opportunity to have more of these sort of companies in our portfolios such as those in the financials and energy sectors. In fact, the financials sector is our biggest overweight position.

Also of note is that when we met him in January, the manager of our Polar Capital Insurance fund, Nick Martin said that he is seeing the best underwriting environment that he has ever seen in his thirty-year career which is not being reflected in valuations of these companies. So there are reasons to be cheerful about the prospects for the share prices of companies in this sector.

In Asia and the Global Emerging Markets there is a feeling from fund managers that, after a decade of US market dominance, it could be their turn to shine. For instance, the Asian region has been more successful in containing the pandemic, with new daily COVID 19 cases per million people, even at peak infection rates, being just a fraction of those in other regions. Long term trends such as urbanisation and the growth of the middle classes in parts of these markets are also good for growth. These trends are set to continue in the next decade in three of the most populous countries in the world – China, India and Indonesia – creating large domestic and consumer-led markets.

There is also the new free trade agreement in Asia which also includes Japan, Australia and New Zealand and some 15 nations, representing almost a third of global GDP. The agreement is expected to eliminate 90% of tariffs between the trading partners and, as a result, Asian companies will be provided with plenty of opportunities to grow in the coming years.

One example of these positive forecasts can be seen in JP Morgan’s long term capital market assumptions which suggest that Asian equities have the potential to outperform developed markets by 2.2% pa over the next 10-15 years. There are also mounting signs that the 10-year dollar bull market is fading further reinforcing the view of many fund managers that the next ten years might go down as the decade for both Emerging Markets & Asia.

Turning to the bond markets and the thoughts from our fixed income managers in recent meetings. Firstly they see attractive opportunities in local currency emerging markets – both the weak currencies and yield spreads over US Treasuries are seen as attractive compared to how they have traded historically.

One sector that has been highlighted by some managers has been financials in general and subordinated debt in particular. Profitability of banks should improve with steeper curves as their traditional business is to lend in the long term and to borrow in the short term. Valuations in subordinated debt are more attractive on a relative basis. It is an opportunity for “high yield like” income with investment-grade company risk.

We asked them what they thought in terms of duration which basically means whether we should be investing in long-dated or shorter-dated bonds – the former are more sensitive to interest rates and are more vulnerable to capital loss if interest rates and inflation rises or are expected to rise.

Here I would say the views are more mixed. Some managers saw the recent spike in yields as an opportunity to increase duration because they think the inflation fears are only temporary and rates should remain low. But some other managers are more concerned and prefer to have a lower duration positioning for the time being as they feel that interest rates could increase further.

If you were to ask them how bullish they are on a scale of one to ten with one being most negative and ten being the most bullish then currently consensus stands at about a seven. We can see that most of the managers are keeping their portfolios with decent levels of credit risk, even more than in February and March last year before the pandemic hit. However, they have some reservations over valuations. All in all, they are bullish with credit as companies will benefit from the higher activity and economic growth that will be boosted by the opening of the economies, in addition to the continued support from central banks.

And finally, we asked them they consider to be the key drivers and events to be aware of over the coming months? These were seen to be evolution of the roll-out of the vaccines and opening of the economies as well as the inflation debate, and whether it will be a temporary issue or a long-term worry, and how central banks react.

Finally, a note on Tuesday’s unsettling press. You may have noticed that stock markets got the jitters amid fears of rising inflation when the US announced its latest figures for the year to March. According to market commentators, the market continues to be nervous of inflation which is clouding the apparent recovery from Covid 19. Surging commodity prices in recent days are a sign of this, and one of the key drivers behind these concerns are the huge infrastructure and stimulus packages in the US.

Inflation figures have now hit 2.6% in the 12-month period to March this year, which breaches the Federal Reserve’s target of 2% and thereby raising fears it might increase rates to cool things down. However, Jerome Powell, the Fed chairman, has stressed repeatedly that he is not thinking of raising interest rates as he believes the rise in inflation is only temporary.

There are similar concerns in other economies, but central banks have so far played down the risks. What we have to remember is that inflation was always likely to pick-up over the next few months given that in the same period a year ago economies were closed and oil prices slumped, and so the figures are from a very low base.

If inflation persists and we are still talking about this in the months to come, then that is a different scenario and will potentially lead to higher interest rates. However, runaway inflation does not look likely and projected growth and inflation rates for many economies look much more subdued in 2022 and beyond.

It does not look as if the Central Banks will change their current stance and raise interest rates any time soon, but the markets and investors are likely to remain wary that inflationary pressures might prove to be persistent and lead the Fed to rethink.

There are two very diverse views in the markets at the moment which are causing a lot of volatility or turbulence as investors try and decide which will win out – strong growth and inflation or weakening economies and unemployment post the ending of various government support schemes, including the furlough scheme here in the UK. As such, expect markets to swing violently around until we get more clarity on what outcome will prevail.

We thought it important to summarise where we stand in terms of portfolio positioning and our thoughts at the current time. Firstly, if history is anything to go by then equities usually do reasonably well through periods of inflation below 5%, despite the wobbles seen across markets on Tuesday. A little bit of growth is broadly good for company profits and it is only when you get runaway inflation that problems really start to occur.

As for bonds, it is not great news as higher inflation may mean higher interest rates which usually means a backup in bond prices.

We are therefore broadly cautious on how we’ve positioned the portfolio due to the current market uncertainty. As such, we have already baked in some inflation protection into our portfolios with many of our investors holding the Twenty Four Monument Bond fund in their fixed interest mix and through exposure to infrastructure via the Legg Mason IF ClearBridge Global Infrastructure Income fund in our specialist equity blend.

The bond fund should do well as it holds variable rate bond holdings which are designed to offer higher interest in periods of higher interest rates and inflation. Meanwhile, the infrastructure fund has exposure to companies with long-term contracts with future pricing linked to inflation levels and so also offer some protection should these inflation levels rise in the future.

We still have cash reserves and will look to start to re-invest this should equities, in particular, begin to take a more significant hit. Should we see equity markets down by more than 10%, we will likely go overweight equities in most portfolios for buying cheap(er) assets has usually served investors well. We are also looking at adding back to the UK Gilt markets should the yield on the 10-year bonds approach 1% where they offer much greater value in today’s miserly markets.

Mark Harries, Chief Investment Officer

Park Hall Financial Services Limited is authorised and regulated by the Financial Conduct Authority.

The information within this article is for information purposes only and does not constitute investment advice. They represent the opinions of the fund manager and those of Square Mile. It does not contain all of the information which as an investor may require in order to make an investment decision. Any reference to shares/investments is not a recommendation to buy or sell. If you are unsure, you should seek professional independent financial advice.

Past performance is not a guide to future performance. The value of any investment and any income from it is not guaranteed and can fluctuate depending on investment performance and other factors. you could get back less than you invested.

Some investments, e.g. property, may be difficult to sell and will be subject to market conditions at that time. Their value is the opinion of an independent valuer.

Any reference to taxation is dependent on your own particular circumstances which are subject to change.