January to March 2020 was the second worst-performing quarter for the FTSE 100 since 1985. The FTSE 100 was down 23.8% and only in the last 3 months of 1987 when the FTSE fell 27% have we seen a more significant drawdown.

Despite the significant recent global market crash, the anecdotal evidence suggests that investors have been investing both before and after the 2019/20 tax year end.

Whilst it is impossible to predict when the markets have bottomed or what the optimum point of entry is – the markets are considerably cheaper than they were 3 months ago – is now a good time to buy? We highlight below some data that supports some benefits of buying now.

Investing for the long term

January to March 2020 was the second worst-performing quarter for the FTSE 100 since 1985. The FTSE 100 was down 23.8% and only in the last 3 months of 1987 when the FTSE fell 27% have we seen a more significant drawdown.

Given this huge fall, many investors may think it’s best to take their money out of the market, with an alternative often being the high street bank. However, the emergency cut in interest rates by the Bank of England to 0.1% (£1 in interest for every £1000 of savings) means that while this may seem like a safer option in the short term, you will get very little return. It is also likely that interest rates will remain low for the foreseeable future.

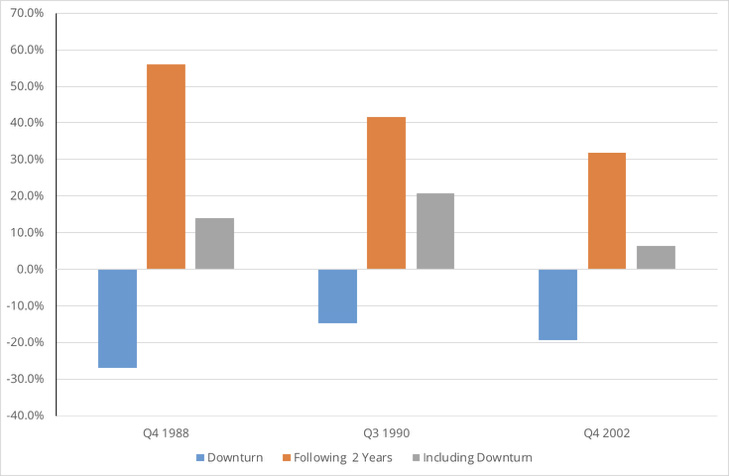

Sticking with investments over the long term may be a better option. The chart below highlights the three worst quarters (excluding this quarter) for the FTSE 100. The subsequent two years shows actual returns in excess of 30% and on all three of these occasions you would have made back money that you lost in the worst quarter. This shows that if you are already invested, there is an argument for sticking with it and if you are not then today might be a good time to invest.

|

Source: FE Analytics.

Some caution should be applied though – past performance is no guarantee of future performance and this pandemic is nothing that markets have seen before. At this point in time, we do not know when we will get back to normality and the longer-term impact isolation will have. For instance, will people continue to pay for expensive gym memberships when they can go for a run, or follow Joe Wicks on YouTube for free?

Overall, history would suggest that if you have the ability to invest, then you will be able to make money over the long term and today might be a good time to buy. However, a number of unknowns mean that markets may fall further before they bounce back and consideration should be given to your personal circumstances.

Park Hall Financial Services Limited is authorised and regulated by the Financial Conduct Authority.

The information within this article is for information purposes only and does not constitute investment advice. they represent the opinions of the fund manager and those of Square Mile. It does not contain all of the information which as an investor may require in order to make an investment decision. Any reference to shares/investments is not a recommendation to buy or sell. If you are unsure, you should seek professional independent financial advice

Past performance is not a guide to future performance. The value of any investment and any income from it is not guaranteed and can fluctuate depending on investment performance and other factors. you could get back less than you invested.

Some investments, e.g. property, may be difficult to sell and will be subject to market conditions at that time. Their value is the opinion of an independent valuer

Any reference to taxation is dependent on your own particular circumstances which are subject to change.